Looking to lower your car-insurance premium? Aren’t we all? Well, one easy way to cut the cost of coverage is to raise your deductible.

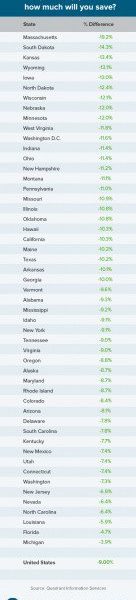

A study published by InsuranceQuotes.com clearly illustrates that higher deductibles result in big savings, though not all drivers benefit equally. Motorists in some states make out like bank robbers while others get shafted. Still, if you increase your insurance deductible – that is the amount a policyholder has to pay before coverage starts – from $500 to $2,000 the national average saving is 16 percent. In some states the reduction was nearly double that at a whopping 30 percent! Without question this is one of the easiest ways to save money on car insurance.

SEE ALSO: How to Drive Through a Roundabout

But two-grand for a deductible is a bit steep for some drivers. What if you increase that number from $500 to a more reasonable $1,000? Well, nationally that still results in a nine percent savings. Residents of Massachusetts, South Dakota, Kansas and Wyoming should reduce their costs the most from this deductible increase. Bay State drivers save the most at more than 19 percent! On the other side of the coin, motorists in Michigan, Florida, Louisiana and North Carolina get thrown under the bus. Drivers in The Mitten State really get screwed, saving less than four percent by doubling their car insurance deductible from $500 to $1,000. Exacerbating this issue, Detroit residents already pay the highest rates for insurance in the whole country.

Click here for more tips and advice.

Leave a Reply